Just after riding the wave of weight loss pills, on the evening of April 28th, Changshan Pharmaceutical (300255. SZ) submitted its worst annual performance report in history.

On April 24th, Changshan Pharmaceutical disclosed information about the acceptance of the application for marketing permission of Ibenatide Injection. Since last May, Changshan Pharmaceutical has continued to speculate on albenatide, which is used to treat type 2 diabetes, and its share price has also taken off from below 5 yuan. At its peak, the company’s stock price rose by 17.98 yuan per share, with an increase of over 300%. Under the cover of high stock prices, several major shareholders frequently reduce their holdings to cash out.

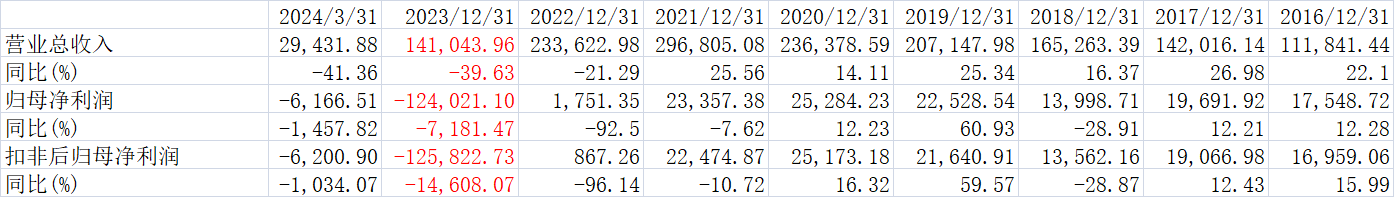

Behind the concept of weight loss pills driving up stock prices, Changshan Pharmaceutical faces the hidden concern of insufficient sustained operating ability as a heparin enterprise. The financial report shows that in 2023, Changshan Pharmaceutical’s revenue further shrank by nearly 40% compared to the previous year, and its net profit attributable to the parent company changed from profit to loss, with a loss of over 1.2 billion yuan, almost missing the total profit of seven years since 2016. Behind the sharp decline was a sharp decline in the sales revenue and net profit of the company’s main business, heparin preparations and raw materials. In the first quarter of this year, the year-on-year loss still showed an expanding trend.

Lose all in one year and make seven years of profit

On the evening of April 28th, Changshan Pharmaceutical disclosed its 2023 annual report and the first quarter report of 2024.

In 2023, the company’s net profit attributable to the parent company was 1.24 billion yuan, compared to a net profit of 17.5135 million yuan in the same period last year, which turned from profit to loss; The operating revenue was 1.41 billion yuan, a year-on-year decrease of 39.63%. Data shows that from 2016 to 2022, Changshan Pharmaceutical’s total net profit attributable to the parent company was approximately 1.24 billion yuan. This means that Changshan Pharmaceutical lost the total profit of the previous seven years in just one year in 2023.

(”,)

(”,)

Moreover, the first quarter report shows that Changshan Pharmaceutical’s basic operating conditions did not improve in the first quarter of this year. In the first quarter of this year, the net profit attributable to the parent company was a loss of 61.6651 million yuan, compared to a net profit of 4.5415 million yuan in the same period last year, which turned from profit to loss; The operating revenue was 294 million yuan, a year-on-year decrease of 41.36%.

According to Wind data, Changshan Pharmaceutical’s profit situation began to deteriorate in 2021, with non recurring net profit decreasing for three consecutive years and the decline expanding. In 2021, the revenue was 25.56% year-on-year, the net profit attributable to the parent company was -7.62% year-on-year, and the net profit after deduction was -10.72% year-on-year. In 2022, the revenue was -21.29% year-on-year, the net profit attributable to the parent company was -92.50% year-on-year, and the net profit after deduction was -96.14% year-on-year. In 2023, the revenue was -39.63% year-on-year, the net profit attributable to the parent company was -7181.47% year-on-year, and the net profit after deduction was -14608.07% year-on-year. The net profit before and after deducting non recurring gains and losses for the past three accounting years of the company, whichever is lower, has been negative, and the audit report for the past year shows that there is uncertainty in the company’s ability to continue as a going concern.

Changshan Pharmaceutical stated that during the reporting period, due to competition in the domestic heparin preparation product market and reduced demand in the foreign heparin raw material industry, the company’s sales unit price of low molecular weight heparin injection and sales volume of heparin raw materials both decreased. These two factors together led to a year-on-year decrease in the company’s operating revenue during the reporting period. Moreover, due to the decrease in demand in the heparin industry and the decline in market prices of crude heparin products, the company has made a provision for inventory depreciation of 632 million yuan.

Specifically, in terms of the three main varieties of heparin preparations, low molecular weight heparin calcium injection achieved a sales revenue of 403 million yuan, a year-on-year decrease of 46.51% compared to the previous year. Despite a significant increase in sales, the sales revenue of nadroparin calcium injection reached 184 million yuan, a year-on-year decrease of 16.36% compared to the previous year. The sales volume of DaHeparin Sodium Injection increased significantly year-on-year, but due to the impact of price decline, it achieved a sales revenue of 177 million yuan, a decrease of 12.74% compared to the same period last year.

In terms of raw material medicine business, there has been a simultaneous decline in sales volume and price. The company’s sales revenue of ordinary heparin raw materials reached 335 million yuan, a year-on-year decrease of 43.90%.

Borrowing weight loss pills to boost stock prices

As a heparin based enterprise, Changshan Pharmaceutical’s theme in the capital market in 2023 was weight-loss drugs, and as a result, its stock price skyrocketed. Before climbing the concept of weight loss pills, Changshan Pharmaceutical’s stock price hovered at a low level below 10 yuan for several consecutive years, and reached a recent low of 4.30 yuan per share at the end of August 2023.

In 2023, GLP-1 receptor agonists are one of the hottest topics in the global capital market. Due to the good performance in weight loss and the influence of celebrities such as Musk, the hypoglycemic drug GLP-1 designed for patients with type 2 diabetes opens the imagination.

Starting from the second quarter of that year, Changshan Pharmaceutical began to frequently release the relationship between Ibenatide and GLP-1. However, the drug is only for type 2 diabetes and does not involve weight loss indications.

On May 24, 2023, Changshan Pharmaceutical replied on the investor relations platform that “Ebenatide and Smegglutide are both GLP-1 drugs.”. Afterwards, Changshan Pharmaceutical continued to release the research and development process of ibuprofen and had multiple interactions with investors on the topic of ibuprofen.

Starting from the third quarter of this year, under the dual factors of continuous speculation and a sharp rise in weight loss drug concept stocks in the capital market, Changshan Pharmaceutical’s stock price began to take off and rose by 17.98 yuan/share on September 16, with a stock price increase of over 300%.

At the end of January this year, Changshan Pharmaceutical disclosed a performance forecast of a pre loss of 1 billion to 1.2 billion yuan, and its stock price fell back below 8 yuan once again.

On the evening of April 24th, Changshan Pharmaceutical disclosed information about the acceptance of the application for marketing permission of Ibenatide Injection, stating that the application for marketing permission of Ibenatide Injection submitted by its controlling subsidiary Changshan Kaijie Jian was accepted by the National Medical Products Administration. On the one hand, the announcement indicates that the accepted indication is to treat type 2 diabetes, and the company has not carried out clinical trials of albenatide against obesity or weight loss; On the one hand, it is said that ebynatide is a long-acting glucagon like peptide-1 receptor agonist (GLP-1RA) that can inhibit gastric emptying and appetite.

After the opening on April 25th, Changshan Pharmaceutical recorded a 20cm limit up, and its stock price closed at 11.77 yuan per share on the same day.

Major shareholders reduce their holdings at a high position

After the stock price took off, the actual controllers and major shareholders took steps to reduce their holdings.

After the market on February 23 this year, Changshan Pharmaceutical announced that the controlling shareholder and actual controller Gao Shuhua intends to transfer his 53 million shares of Changshan Pharmaceutical (accounting for 5.77% of the total share capital of the listed company) to a natural person Yang Minghuan through an agreement transfer method due to his own financial needs. The transfer price of the target shares is 9.2 yuan per share, with a total amount of 488 million yuan.

On March 14th, the transfer procedures for the agreement transfer have been completed. The number of shares held by Gao Shuhua decreased from 334 million to 281 million, and the shareholding ratio decreased from 36.43% to 30.64%.

For Changshan Pharmaceutical, the equity pledge of the actual controller is also worth paying attention to. According to the first quarter report, as of the reporting period, Gao Shuhua had 199 million shares pledged, accounting for 71.06% of its 281 million shares held.

The second largest shareholder, Guotou High tech, is also continuing to reduce its holdings.

According to the announcement on March 19 this year, from November 21, 2022 to the announcement date, the number of shares held by China National Investment Corporation High tech decreased from 84.827 million to 45.953 million, with a reduction of 38.874 million shares. Among them, from October 11, 2023 to the announcement date, China National High tech Investment Corporation reduced its holdings by 17.45 million shares through bulk trading, with an average reduction price of 10.34 yuan per share and a profit of 180 million yuan from the reduction. As of March 31st, the shareholding ratio of Guotou High tech has dropped to below 5%.

In addition, during the third quarter of the sharp rise in stock prices, five shareholders including Hebei Huaxu Chemical and JPMorgan Chase reduced their holdings by a total of 11.609 million shares. The shareholder with the largest reduction in holdings is Hebei Huaxu Chemical, which reduced a total of 9.343 million shares in the third quarter.